Most Affordable Corporate Tax Automation Software

For tax practitioners in corporate secretarial & accounting firms.

Unlock up to 50% productivity today.

Try for free

Spending too much time on tax computations, referencing & formatting? And worrying over human errors? Let that end today.

Lower Compliance Cost by Increasing Your Efficiency & Accuracy

Achieve a 30x ROI on your subscription cost today!

Pre-formatted Schedules & Auto Referencing

Focus on tax adjustments & let us handle the manual and painful work.

Export & Upload Functions

Export data (P&L, fixed assets) from accounting systems & upload into Tax Savy to reduce manual work & typos.

Built-in Calculator

Show transparent & traceable computations.

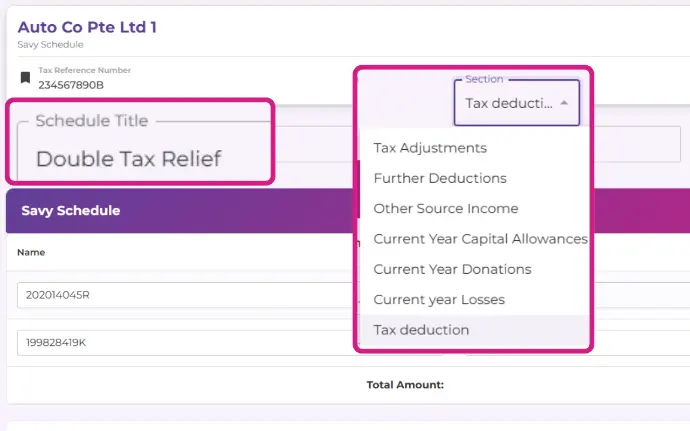

Flexible & Custom Schedule

Build your own schedule to take into account unique requirements & changes in tax laws.

Easy Onboarding with Free Support

No hidden cost or costly training. Access detailed user guides & support easily.

Unmatched Security for Your Client's Data

Our server is hosted on cloud infrastructure that meets ISO 27001 and SOC 2 standards.

Plan Options

In-house Tax Practitioner

For corporate secretariats preparing tax computation for small corporate groups

Try for free- Full access to all features

- Create up to 5 companies

- Incremental cost at only $3 / company

Tax Professional

For tax departments of accounting & audit firms, or large corporate groups

Try for free- Full access to all features

- Create unlimited number of companies

Unsure how to classify fixed assets into their appropriate capital allowances categories? Here's a bonus guide.

By providing your personal data and/or using our services, you consent to Savy Solutions Pte Ltd collecting, using, and disclosing your personal data in accordance with the Personal Data Protection Act 2012 (PDPA) of Singapore and our Privacy Policy.

Your personal data may be used for the following purposes:

- Processing transactions and providing services requested by you

- Communicating with you regarding our services, promotions, and updates

- Complying with legal or regulatory requirements

You may withdraw your consent at any time by contacting us at enquiries@taxsavysg.com, subject to legal or contractual restrictions. For more information on how we handle your personal data, please refer to our Privacy Policy. By continuing to use our services, you acknowledge and agree to the collection, use, and disclosure of your personal data as described above.

Contact Us

We'd love to hear from you! Whether you have questions, feedback, or need support, our team is here to help. Simply fill out the form below, and we aim to respond to all enquiries within 24 hours.

Thank you for getting in touch!