Under the Enterprise Innovation Scheme (EIS), there’s an important rule to keep in mind: if you’re claiming enhanced deductions for acquiring IPRs, you’ll need to own those IPRs for at least one year — this is referred to as the “1-year ownership period.”

If the IPR is disposed of before this period ends, clawback provisions kick in. But don’t worry — we’ll break it down step by step so you know exactly what to look out for.

🧾 Summary of the Clawback Provision

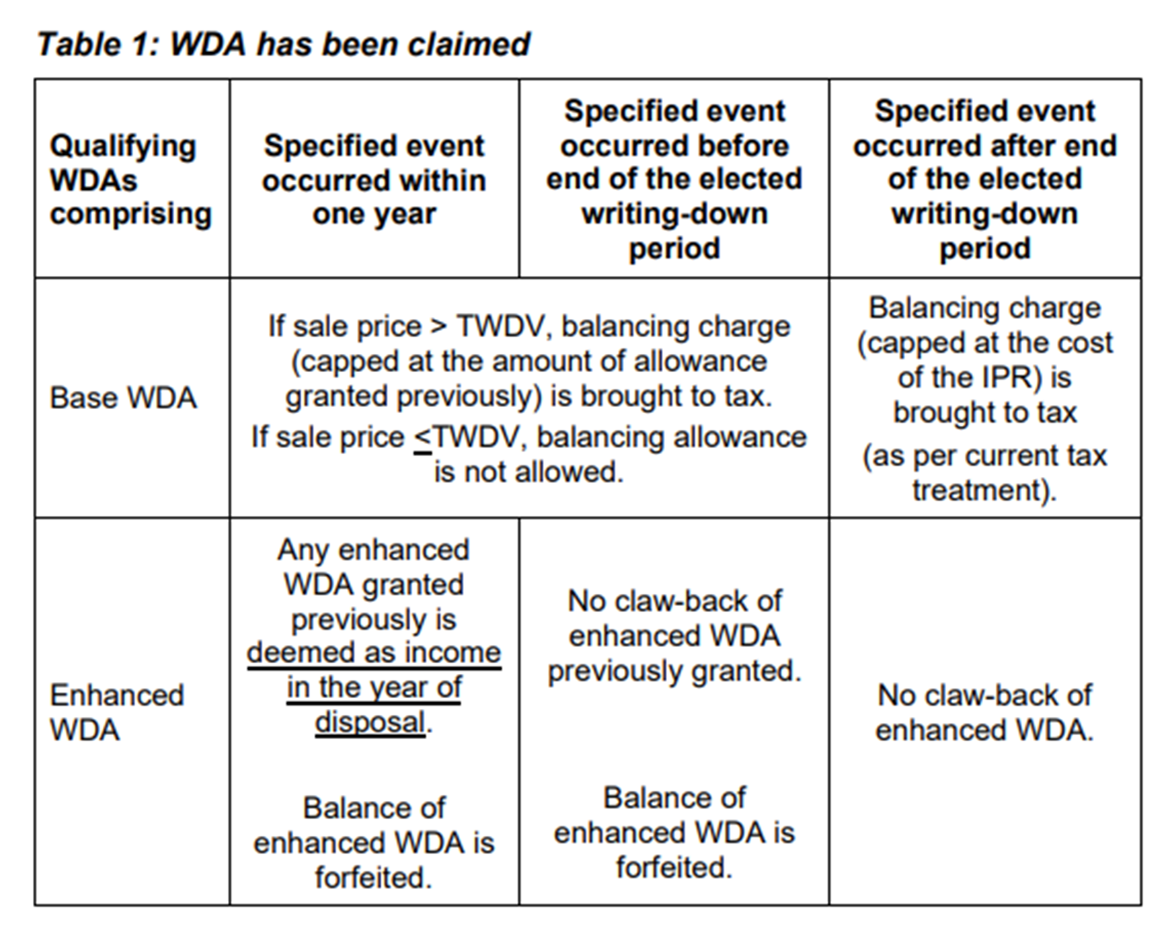

Here’s a quick snapshot of the rules, based on IRAS’ e-Tax Guide:

Extract from IRAS' e-Tax Guide on EIS (Section 5.4 Page 27)

🧩 How to Handle Clawback Provisions for IPRs in Tax Savy

Let’s walk through exactly what you need to do in Tax Savy to replicate the correct clawback tax treatment under the EIS. We’ve split it based on the Allowance Type (Base vs Enhanced) and when the specified event took place.

For Base Allowances

When IPR was disposed | What to do in Tax Savy |

Specified event occurred within one year | Where sales price > TWDV, enter actual sales price in FA Disposal Schedule and BA/BC will be computed accordingly. Where sales price < TWDV, enter TWDV as sales price as BA is to be disregarded. |

Specified event occurred before end of the elected writing-down period | Same as above. Use actual sale price if it’s higher than TWDV, or TWDV if the sale price is lower. |

Specified event occurred after end of the elected writing-down period | Just enter the actual sales value. Tax Savy will take care of the BA/BC computation automatically. No special steps needed. |

For Enhanced Allowances

When IPR was disposed | What to do in Tax Savy |

Specified event occurred within one year | 1. In the S19B Schedule, enter the enhanced TWDV in the Disposal column. This will forfeit the remaining enhanced allowance. 2. Separately, create a new schedule and add back the enhanced allowance already claimed — this reflects the clawback. |

Specified event occurred before end of the elected writing-down period | 1. Enter the enhanced TWDV in the S19B Schedule as above to forfeit remaining claims. 2. No need to add back previously claimed enhanced allowance — just the forfeiture will do. |

Specified event occurred after end of the elected writing-down period | No clawback needed. Just proceed as normal — no extra steps required. |