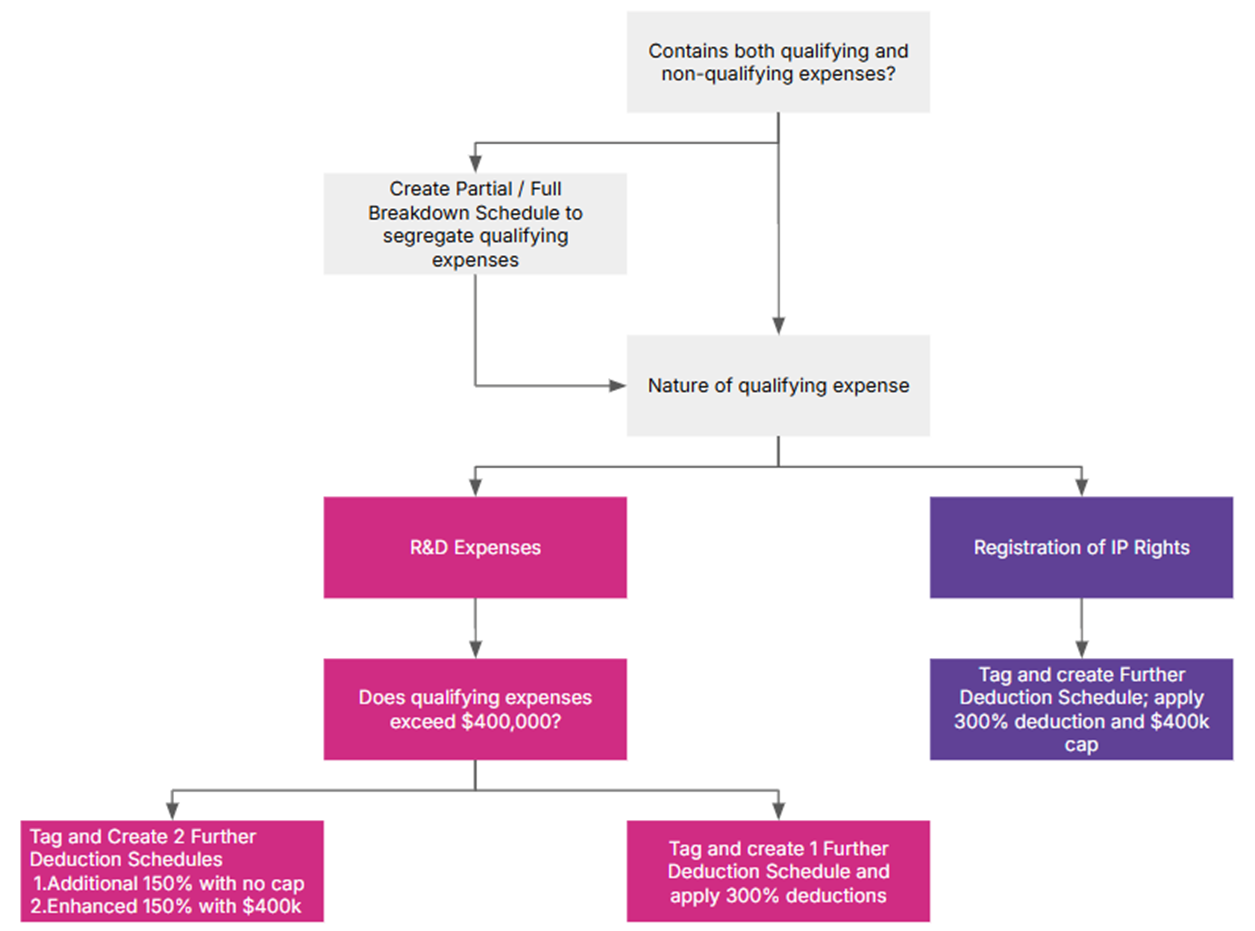

When it comes to tagging enhanced deductions or allowance for Enterprise Innovation Scheme (EIS) — there are a few things you’ll want to keep in mind to get it right. Let’s walk through it step by step.

🧐 First, Ask Yourself a Few Quick Questions:

Before you start tagging away, pause for a sec and check:

- Is the amount in your Detailed P&L a mix of qualifying and non-qualifying expenses?

- What kind of qualifying expense are we talking about?

- Is it IP registration?

- Or R&D-related?

- And here’s the big one: Does the qualifying portion exceed $400,000?

Tag It Right: Two Common Scenarios

✅ Scenario 1: Both Qualifying & Non-Qualifying expenses

If your line item in the Detailed P&L includes both qualifying and non-qualifying stuff, you’ll want to break it down:

- Use a Partial or Full Breakdown Schedule to show what portion is actually eligible

- Under Tax Adjustment, select "Further Deduction"

- Tag the line to automatically create a new Further Deduction Schedule

✅ Scenario 2: All Qualifying

If the amount is fully qualifying, it’s even easier:

- Just select "Further Deduction" directly under Tax Adjustment

- Tag it to spin up a new Further Deduction Schedule

📊 Applying the Deduction % and Expense Cap

Depending on the type of expense, the % deduction and cap might change a little.

📌 For IP Registration:

- Just tag it to a Further Deduction Schedule

- Simply apply a 300% deduction and an expense cap of $400,000

🔬 For R&D Expenses:

There are two alternatives, depending on the amount of qualifying expenses.

- If it’s $400,000 or less:

- Tag it & create one Further Deduction Schedule.

- Apply a full 300% deduction on the qualifying amount.

- If it’s more than $400,000:

- You’ll need two schedules:

- One for the addition portion, where you also apply a 150% deduction, but with no cap.

- Another for the enhanced portion, where you apply a 150% enhanced deduction (with a $400,000 cap).

- You’ll need two schedules:

For a clear overview of the steps, check out the flowchart below — it maps everything out so you can see how the process flows at a glance.